With the increasing incidents of violence and security threats, schools are seeking effective and efficient ways to enhance safety and security measures. And for this, the perfect solution is – OneStop School Gate Pass Management Software / Visitor Management System for Schools.

Visitor Management System not only enhances the safety and security of educators, parents, and students but also increases the productivity of people at schools and keeps records of people entering schools. It provides a safer and more controlled environment for students, faculty, and staff.

In this article, we will look into important aspects of a visitor management system for schools.

What Is a Visitor Management System for schools?

A visitor management system (VMS) is a software solution designed to manage and track visitors who enter and exit the campus. It streamlines the check-in process, automates the identification and registration of guests, and provides real-time data on who is on the school premises. In addition, it can help to monitor the movement of visitors throughout the campus and restrict access to certain areas of the school. It is a secure and efficient way to handle visitor check-in, particularly in high-traffic areas, like school entrances.

VMS software can capture the visitor’s name, contact information, and photo, along with the purpose of their visit and the time of their arrival and departure.

Why do Schools Need Visitor Management Systems?

Schools are vulnerable to a wide range of security threats, including external threats from individuals seeking to do harm, and internal threats from students or staff. School Visitor management systems are essential to help mitigate these risks and ensure the safety of students, staff, and visitors.

A. Keep Students Safe from External Threats

Schools have a duty to protect their students from external threats. A digital visitor management system in schools identifies all the visitors before they enter the school premises, which can help prevent potentially dangerous individuals from gaining access. By keeping unauthorized visitors out, schools can create a safer environment for their students.

B. Protect Staff from Potential Harm

Staff members are also at risk of harm from external threats. A visitor management system in schools can help to protect staff members by ensuring that only authorized individuals are allowed on school grounds. This can help prevent incidents such as workplace violence, harassment, or theft.

C. Prevents Unauthorized Access to the School

Unauthorized access to the school can pose a significant security risk. Visitor management systems can help prevent unauthorized access by requiring all visitors to sign in and obtain a visitor badge. This not only helps identify who is in the school, but also serves as a visual reminder to students, staff, and visitors that only authorized individuals are allowed on the premises.

D. Track Visitor Activity and Data

In addition to enhancing security, a visitor management system can help schools track visitor activity and data. This can be useful in the event of an incident, as it can provide valuable information about who was on school grounds at a particular time. Additionally, tracking visitor data can help schools identify patterns or trends in visitor behavior, which can be used to enhance school security measures.

Limitations of Paper Log Book for Visitors Records

Many schools are still using a paper-based visitor log book to keep records of all their visitors. But a paper-based solution has many limitations:

- The records stored in a book are difficult to manage and search

- Records are prone to damage and loss, theft when stored Physically

- Sharing the records is impossible without physically coping them

- Physical log logbook also does not store visitor information such as photo

- Screening visitors is also impossible with a paper logbook

- Impossible to carry out a performance check & access visitors’ activity report

- It is impossible to consolidate records in one place if you manage multiple schools.

- During an emergency, visitor log books are ineffective in showing a list of visitors present in a school

How to Choose a Visitor Management System for Schools?

Choosing the right visitor management system for your school is crucial to ensuring its effectiveness. Here are some key factors to consider when selecting a system:

A. Research different visitor management system options

Do your research on different visitor management systems to identify which options will meet your school’s needs. Look at factors such as price, features, customization options, and customer support to help you make an informed decision.

B. Consider factors such as cost, ease of use, and customization options

When selecting a visitor management system, consider your budget and ensure that the system you choose is cost-effective. You should also look for a system that is easy to use, with a simple check-in process for visitors, and customizable to fit your school’s specific requirements.

C. Determine which system best meets the needs of your school

Once you have evaluated different options, choose the system that best meets your school’s specific requirements. Consider the size of your school, the number of visitors you receive on a regular basis, and the security features that you need to keep your school safe.

Choosing & implementing a visitor management system in schools can be a complex process, but by following these steps, you can ensure a successful implementation that provides enhanced security measures and a streamlined visitor check-in process.

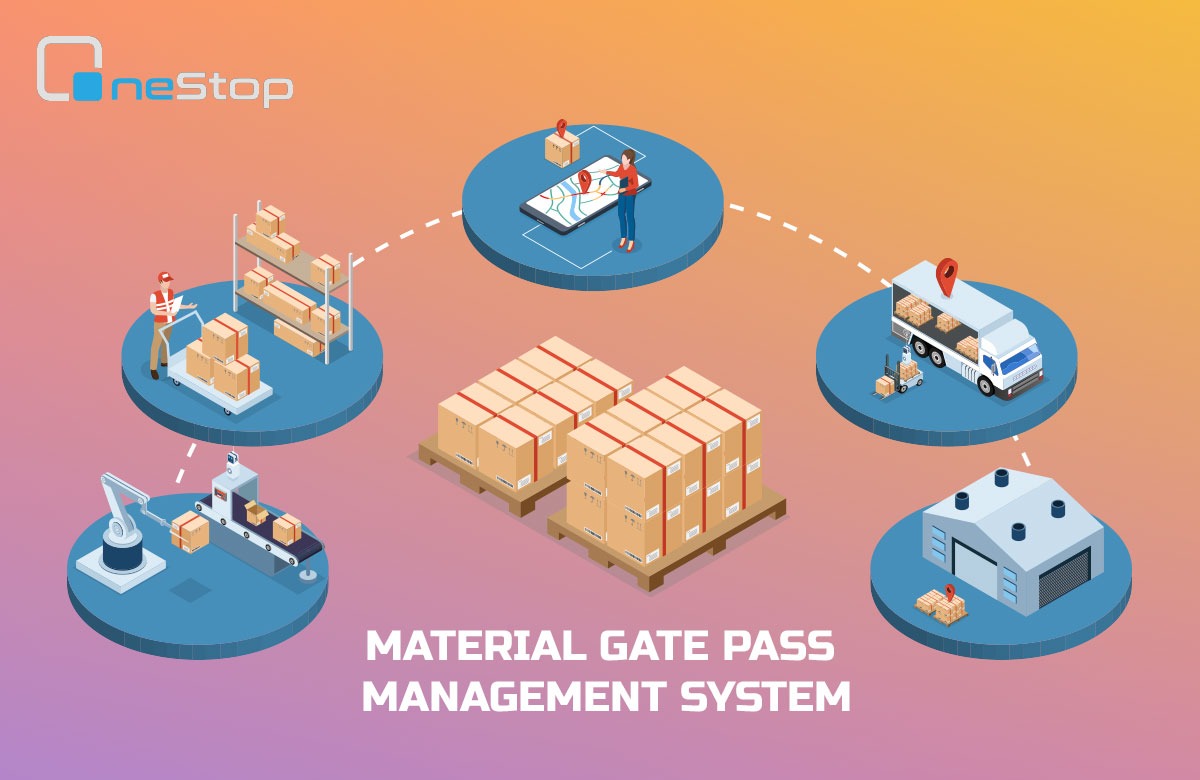

Read : Benefits of Cloud Based Gate Pass Management System

Benefits of OneStop Visitor Management System in Schools

OneStop visitor management system in schools can provide a number of benefits such as

Enhances School Security and Safety

Visitor management systems in schools enhance security measures. It also screens visitors before they are allowed to enter the school, preventing unauthorized access, potential security breaches, and other incidents that could put students and staff at risk.

By enhancing school security and safety, visitor management systems can create a more secure learning environment for students and staff.

Streamline Visitor Check-in Process

A visitor management system streamlines the visitor check-in process, making it faster and more efficient for visitors and staff. Instead of manually recording visitor information, a visitor management system automates the process by capturing visitor information and printing visitor badges. This can save time and reduce errors, allowing staff to focus on other important tasks.

Customization Options for Schools

Gate Pass software can be customized to meet the unique needs of each school. Schools can choose to include specific security features, such as facial recognition or background checks, to enhance their security measures. Additionally, visitor management systems can be customized to match the school’s branding, making them a seamless addition to the school’s overall appearance.

Easy Tracking of Visitor Activity and Data

A visitor management system can provide schools with easy access to visitor data, allowing them to track visitor activity and trends. This data can be used to improve the school’s security measures, identify potential risks or threats, and track visitor behavior over time. Additionally, visitor data can be used to generate reports for school administrators and security personnel, providing them with valuable insights into the school’s security posture.

Real-Time Reporting

Onestop School Gate Pass Management, a web-based report provides insights such as:

- List of current sign-ins in a school

- Access details of visitors

- Trend graph of the number of people visiting a school

Records School Faculty / Staff Check-in – Check out

Onestop Visitor Management System has inbuilt faculty and staff management system. So, school faculty and staff members can sign in – sign out to school every day.

Real-Time Reports of Multiple Location

Schools can be located in multiple locations. Therefore, monitoring visitor flow across these locations is difficult and challenging.

Onestop Visitor Management System has a location management feature too. It will provide a single interface to track visitors and control their access, and save time.